Natural Investments recently converted its company ownership from six financial advisors to the Natural Investments Purpose Trust. That’s right, we’re now essentially owned by a purpose!

Creating this trust over the past 18 months means that Natural Investments will continue to exist in perpetuity

as an independent firm owned by an entity rather than individuals. Now advisors and staff are elected by our advisors to serve terms as trust stewards who have ownership-level authority to prioritize the firm’s strategic direction. The change reinforces our commitment to sharing governance power among members of our increasingly diverse team.

It’s an exciting moment in Natural Investments’ history. Democratizing our ownership structure empowers new decision-makers, facilitates gender and racial equality in determining the priorities and direction of the company, assures a careful and gradual leadership succession, and yields wider economic benefits.

To assure business continuity, four of the six previous owners – Christopher Peck, Malaika Maphalala, James Frazier, and myself – have been appointed initial trust stewards, and we are joined by three advisors elected by our team: Carrie VanWinkle, Nicole Middleton Holloway, and Ryan Jones-Casey. These seven people form the Trust Stewardship Committee.

In addition, Christopher and I shall remain as managers of the firm, so there are no discernable changes in our operations or impact to clients as a result of this ownership transition.

Our Ownership History

Natural Investments traces its origins back 38 years to founder Jack Brill, who in 1985 became one of the

first socially responsible investment advisors in the country. His son Hal joined him in 1989, and I became one of the firm’s early clients in 1990.

In the 2000s, after several years with the firm as financial advisors, Christopher and I became co-owners with Hal in 2007, at which time we became Natural Investments, LLC. The firm has always been owned and operated by its advisors; there has never been a central office with executive employees running the firm, so owners manage firmwide responsibilities as well as serve clients. This has ensured major decisions were made collectively, in the best interests of clients, and in a manner that sufficiently supported advisors in being of service to them.

As we brought on additional advisors in the past 16 years, our long-term plan was always to pass on firm management and ownership to younger advisors. While the firm was initially owned equally by Hal, Christopher, and myself for 10 years, in 2017 Hal sold some of his stake to three other advisors: Malaika, James, and Greg Pitts. Our hope was to continue down this path, with each partner gradually selling ownership stakes to younger advisors over time to assure the firm would be led by additional people who shared the firm’s core purpose, values, and management style.

Unexpectedly, since our humble beginnings managing $50 million decades ago, we became a “victim of our success.”

By growing our assets under management nearly fortyfold, the significantly higher valuation of the company led advisors to turn down the opportunity to purchase even small ownership stakes due to the high cost, raising a critical concern for how internal ownership succession could possibly occur.

Faced with similar circumstances, smaller companies traditionally sell to a larger firm, or advisors take on equity partners to facilitate ownership transitions. This syphons off profit and sometimes control. Even though companies are regularly offering to buy NI, we vowed to do what we could to retain our independence, self-governance, and capital – especially after seeing the challenges other firms experienced when involving outsiders.

Meanwhile, as the firm slowly added financial advisors to achieve gender parity and 25% people of color, we also aimed to diversify company ownership as part of our ongoing commitment to racial and gender equity, to share power more broadly, and to equitably share profit. The perpetual purpose trust is a great way to manifest these goals.

What is a Perpetual Purpose Trust?

This innovative ownership model transfers sole ownership of a business from individual owners to a trust that exists to serve the specific purpose of supporting the mission of a company. Those intimately involved with the company serve terms as elected trust stewards to guide the company, similar to a board of directors overseeing organizations. The trust stewards fulfill the same responsibilities as individual owners: assuring the firm’s fiscal solvency, growth, and profit-sharing among stakeholders.

In our case, the trust’s purpose is to preserve and enhance the viability of the firm to support advisors in carrying out Natural Investments’ vision and mission.

The Natural Investments Purpose Trust’s stated objectives are:

- Sustain our fiduciary duty to clients.

- Ensure advisor autonomy and encourage collaboration for the good of the whole of the firm.

- Aim for a budget that reasonably balances the firm’s operational reserves, expenditures, and profit distribution.

- Provide infrastructure and ongoing regulatory, legal, and administrative services that bring value to advisors.

- Share economic rewards equitably among all advisors.

- Operate responsibly and equitably for the benefit of advisors, staff, clients, communities, society, and the environment.

- Promote an inclusive sharing of power in firmwide decision-making.

The significance of this last point around decision-making is that the shift to the Trust Stewardship Committee has instantly changed the longstanding power dynamics of the company. Until now, individual voting power was tied to the percentage of ownership stake, and since 2007, Christopher and I collectively had 67% of the voting authority.

Now every trust steward’s vote is equal, and no one has more power than anyone else.

Christopher and I now have 28% of the power. We have essentially given up majority control of the company as part of the sale to the trust.

With Christopher, Malaika, James, and me transitioning to the Trust Stewardship Committee, our co-founder Hal Brill and partner Greg Pitts are choosing to step out of their leadership roles. We acknowledge their dedication and strong guidance over the years with tremendous gratitude.

The firm wouldn’t be where it is today without Hal’s 30-plus years of wise oversight and heartful inspiration.

Joining the four former partners on the Trust Stewardship Committee are three elected trust stewards from our advisor and staff stakeholder team: Carrie, Nicole, and Ryan. What’s particularly exciting about electing new people is that they can assume the responsibilities of leadership without having to assume the extensive debt that the previous form of ownership would have required of them to earn voting power.

These advisors are well-suited for the role, as they have already demonstrated leadership within the organization

by serving on committees addressing investments, racial equity, practice management, retreat planning, B Corp recertification, and the governance committee that helped shape the trust. We extend a very warm welcome to Carrie, Nicole, and Ryan in their new roles and look forward to their ongoing leadership contributions.

One manager of the company will have a permanent seat on the Trust Stewardship Committee; everyone else will serve staggered terms of three years. Everyone is re-electable and we are not implementing term limits, but we anticipate many advisors and staff serving elected terms as trust stewards over time to make ownership-level decisions that guide the firm into the future.

There is also a trust enforcer, who monitors the Trust Stewardship Committee to assure that it operates in support of the purpose, and if not, to hold the committee accountable. Retiring financial advisor Susan Taylor is fulfilling this role for us at the outset.

How Did We Convert Ownership?

In 2020, some of our accredited clients invested in Organically Grown Company (OGC), a wholesale distributor of organic produce in the Northwest, to support its ownership transition to a perpetual purpose trust. The pioneering of this approach generated so much interest –Patagonia recently adopted it – that OGC created a consulting firm, Alternative Ownership Advisors (AOA), to help other businesses convert to a perpetual purpose trust or other alternative ownership models.

In 2021, we hired AOA’s consultants Peter Koehler, Natalie Reitman-White, and Elle Griffin to look at various ownership structures that could potentially fulfill our goals. Once we selected the perpetual purpose trust as our preferred model in 2022, we hired AOA again to help with its implementation. AOA spent the past six months designing the Trust with attorney Jenny Kassan to draft our documents, create a financial model to finance the sale, then structure and execute the sale.

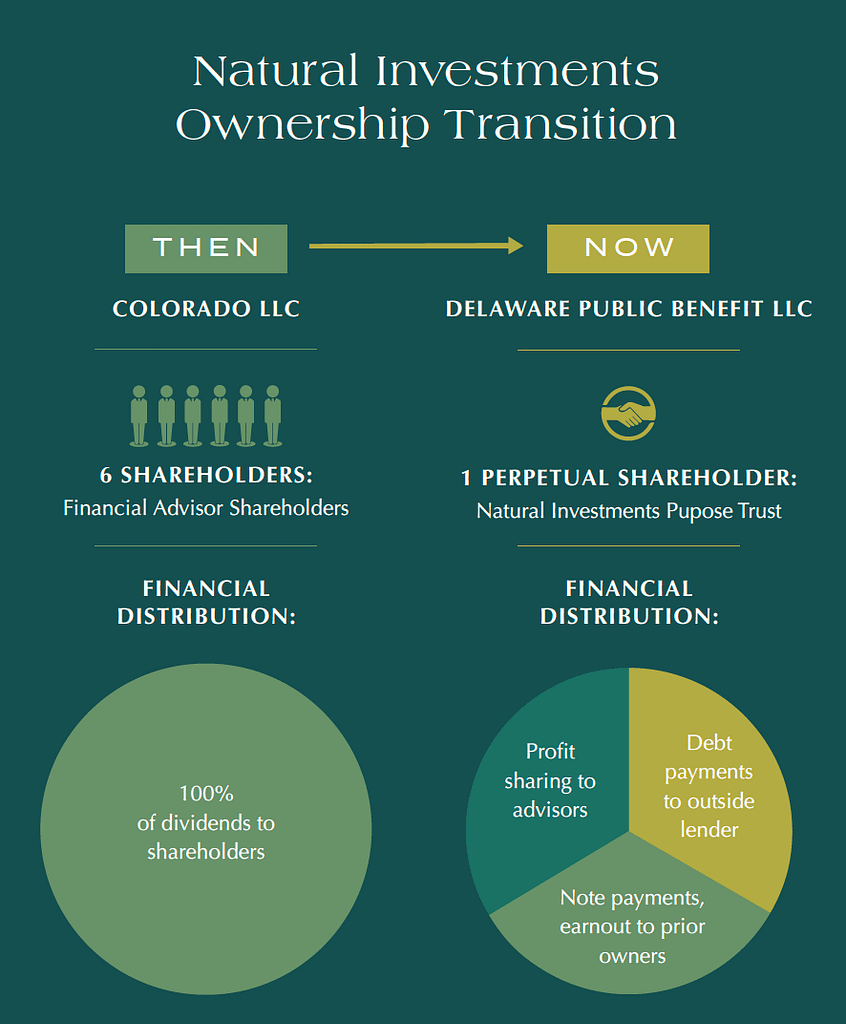

As part of this transition, we also converted our Colorado-based LLC to a Public Benefit LLC registered in Delaware.

Delaware is one of many states to have crafted benefit corporation legislation that codifies the tracking and reporting of multi-stakeholder benefits for businesses. Being a benefit corporation under state law complements our 2007 certification by B Lab as a Founding Certified B Corp.

How Did We Finance the Sale?

The sale of the company to the trust involves a combination of external and owner financing. Exiting owners are being paid a significant majority of their share value over many years.

To provide a down payment to selling partners, the firm borrowed one-fourth of the sale price from a longstanding community development financial institution that shares the firm’s values. This seven-year note marks the first time in the firm’s 38 years that it has borrowed capital.

While this ownership change marks the end of an era comprised of pioneering spirit and tremendous growth of people, capacity, assets, and impact, we are confident that this transition in our structure best secures our ownership, reflects our collaborative, evolutionary, and gender and racial equity values, and supports our advisors’ work as fiduciaries of client assets for decades to come.