Environmental & Social Impact

Of the $524M in assets under management by Natural Investments, $354M is in ESG-screened funds on the publicly-traded market. ESG refers to a variety of environmental, social, and corporate governance guidelines, known as avoidance and affirmative criteria, used to screen investments. We use them to steer clear of the practices and sectors that cause harm to people and the planet, pressure companies to change their behavior, and support companies and projects that lead to a more just and sustainable society.

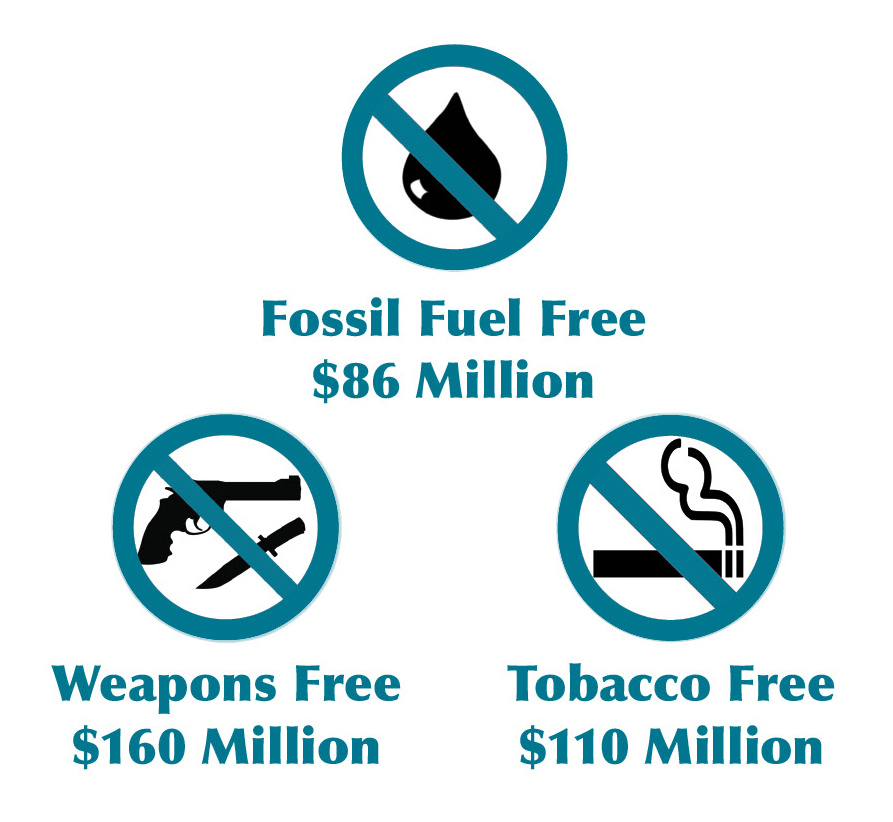

While we directed $160M and $110M of assets into weapons-free and tobacco-free funds, our fossil-fuel-free (FFF) portfolio has garnered great interest among clients. Currently FFF portfolios that omit the world’s largest oil, coal, and gas producers are at $86M, and the trend is growing quickly in response to global concerns over climate change.

Community Investments

More than $63M is invested in community finance products, including municipal bonds and community development notes, that bolster affordable housing, schools, health care clinics, assisted living centers, small businesses, and appropriate infrastructure that strengthens communities and protects ecosystems.

Regenerative Capital

A key element of Natural Investments’ ethos is to connect our clients with “high-impact” regenerative investments not found in the public market, which often has prohibitive barriers to entry for innovative investments. These private equity and private debt investments support sustainable and regenerative agriculture, water restoration projects, minority entrepreneurship, and clean energy. Currently, there are 45 high-impact opportunities funded through Natural Investments, one of which is Iroquois Valley Farms.

Approximately $44M is directed to private market solutions that we call “regenerative investments”—in high-impact areas such as renewable energy, ecosystems conservation, worker cooperative funds, affordable housing, and other areas selected for their potential to positively transform our society.

Shareholder Advocacy

Our firm took more than thirty different actions over the course of 2018, advocating on environmental, social, and governance issues such as climate change and antibiotics use in livestock production. Following the tragic Parkland shooting in Florida, we joined an investor coalition asking financial firms such as Wells Fargo and American Express to add oversight to the processing or financing of firearm sales. This included universal background checks, buyers’ minimum age of at least twenty-one, and prohibiting the sales of bump stocks.

We signed a global investor statement to RSPO (Roundtable on Sustainable Palm Oil) in Malaysia to create a more transparent and responsive complaints mechanism for stakeholders to report labor issues in palm oil production. Major companies such as PepsiCo, Nestlé, Cargill, and Citigroup participate in the group and rely on timely resolution of complaints filed. After the passage of SESTA (Stop Enabling Sex Traffickers Act) and FOSTA (Allow States and Victims to Fight Online Sex Trafficking) in April 2018, we asked AT&T how its board and management was approaching the new obligations in protecting children from online sex crimes.

Amazon avoided meaningful engagement with concerned shareholders, instead seeking no-action relief at the SEC for 24 of 35 resolutions brought by its shareholders. Our letter asked that Amazon work collaboratively with investors on the company’s exposure to some of society’s most significant social issues. Examples include addressing the gender pay gap within its firm, identifying human rights risks within its operations and supply chain, and disclosure on the use of criminal background checks in hiring decisions.

Public Policy

With regards to the U.S. Securities & Exchange Commission, we have written letters to agency members and Congress to urge them to refrain from increasing oversight on proxy access unnecessarily and to not raise thresholds for re-filing shareholder resolutions. We also asked that the agency to formalize guidance on ESG (environmental, social, corporate governance) disclosure rules by companies so that investors have a standard information framework.

Download a full copy of the 2018 Social Impact Report.